Time heals all wounds, Except Panic Selling

We are only human.

This means that we the capacity to be rational, but we also use this capacity to rationalize irrational behavior, and numerous studies have shown we do this constantly without realizing, especially when it comes to economic decisions.

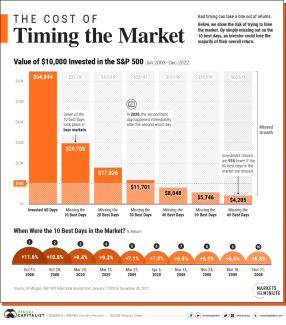

Trying to time the market is one of the biggest mistakes an investor can make. The idea of buying low and selling high makes perfect sense, but our ability to rationalize makes it much more likely for us to fail when trying to do that.

How can that be?

Fear, greed, and cognitive biases.

An example of inadvertently buying high:

The people who bought bitcoin the fall of 2021. After having seen the price go up over 500% in a year to new all-time highs; FOMO[i], greed, and the recency bias[ii] tempted people to rationalize that buying bitcoin at $60K was buying low, it was up 5x in a year, and at an all-time high! If you assume that what just happened would continue, then bitcoin goes up, and it will never be this low again so even at an all-time high I am buying low. (NOPE!)

An example of inadvertently selling low:

Some of the same people who bought into bitcoin when it crossed $60K panicked and sold over the next year or less at a huge loss. The narrative had changed, the recent past became one in which bitcoin goes down! If you assume what just happened will continue than you can rationalize selling, it will never be this high again! It only goes down, so selling it for half of what it cost is selling high. (NOPE!)

It’s often said that the best story wins but keep in mind that cognitive errors can make the stories we tell ourselves wrong and letting those stories “win” is an avoidable mistake.

It is tempting to want to be able to “get rich quick,” and our capacity for remembering or creating stories makes it seem attainable (see narrative fallacy, or hindsight bias), but the real secret is that it takes small actions over time and the power of compounding.

Now, had you bought bitcoin at the all-time high back in 2021 and gone into a coma, you would see that bitcoin sits currently above $72,0000, up more than 25% in less than 3 years (It is currently March 12th, 2024, let’s see how this ages). The point is not to invest in bitcoin, the point is that investments and the investors who hold them can have very different performance, especially when investors are short-term. Our brains didn’t evolve to make long-term decisions, our gut instincts do not understand the power of compounding, or statistics, even if we studied statistics!

The recency bias leads people to overestimate the chance that what just happened will continue to happen. Herd mentality[iii] and overconfidence[iv] can lead people to jump on the same bandwagon often after a big runup. This is the perfect recipe to set yourself up to buy high. In addition to the recency bias also working against you on the way down another cognitive bias that fuels selling low is loss aversion,[v] we feel the pain of losing about twice as much as the joy of winning so we are more likely to bail when things get ugly than we assume we would be.

We tend to overestimate what appears to be a current trend and lose sight of the probability that things will normalize over time.

Our emotions tempt us to make rash decisions which usually are not ideal when investing long-term. Keeping a long-term perspective is easier said than done, but it’s our job to help you do that, especially when your intuition is working against you.

*All indices are unmanaged and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fess, charges or expenses. Past performance does not guarantee future results.

*This article is strictly for educational purposes and is not a recommendation for or against cryptocurrency.